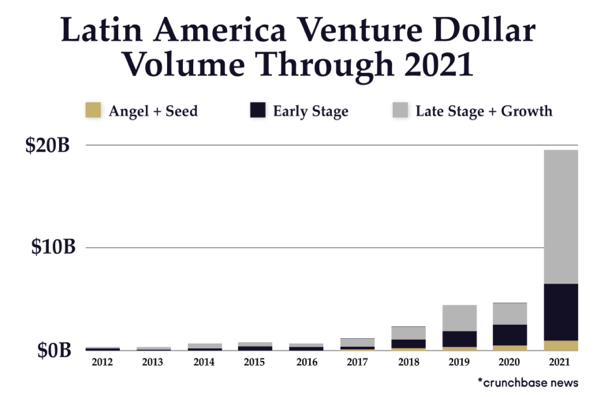

After many years of being the last one picked in the lineup, Latin America (LatAm) is finally starting to draw Venture Capital (VC) attention. 2021 was a banner year, with investment growing by 3.5X in the region and LatAm minting 26 new unicorns, or businesses that are valued at $1 billion before being listed in the stock market.

Traditionally seen as a laggard in technological advances, LatAm is also fast adopting digital evolutions and keeping pace with current tech trends in Europe and the United States.

With new communities across the region getting on the digital interface at increasingly exponential speeds coupled with the fastest e-commerce growth of any region during the pandemic—totaling an estimated $80B and expected to double by 2025—a new page for the region’s enterprise seems to be turning.

In response to all of these factors combined, some analysts are even comparing LatAm’s rapid progression pace with the rate of growth seen in the early days of Silicon Valley.

Although both business and technological progression seems to be certain, LatAm is still developing in some ways and there are several key factors that need to be matured for this economic advancement to have longevity in LatAm.

The Bogota Post sat down with one LatAm Venture Studio Founder to outline some of the key shifts that need to occur in order for this exponential region to utilize its full potential as well as sustain it in venture capital investment.

Bridging the Economic Gap

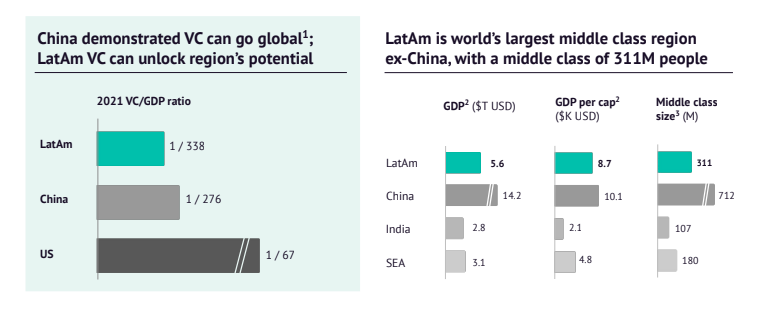

Coming into its own in a fraction of the time as many other regions of the world, LatAm seems to be the underdog looking to prove itself in 2022. This can be seen with countries Brazil and Mexico on track to overtake some of the largest economies in Europe in terms of GDP over the next decade.

Even with this quick economic progression, LatAm’s income inequality still shows huge disparities. A study in 2020 showed that the trend toward poverty reduction and greater equality that started 20 years ago has reversed in response to ongoing after-quakes of the pandemic. Socioeconomic differences between the lower, middle and upper classes cannot be ignored, and action needs to be taken during this economic boom to ensure that a fair income distribution comes from its tidings.

“I think there are, in essence, two societies that coexist in LatAm, they interact, but they don’t integrate and the resources from one don’t go to the other,” says Founder & CEO of Venture Studio Polymath, Wenyi Cai. “LatAm is an economy that is very fragmented, making for many jobs from informal businesses, very low access to education and the networks that come with education, and, in many ways, variable access to markets.”

Variable access to markets is probably one of the key determinants of the continued divergence between the upper and lower classes.

“Systemic change can’t be this finite, cut dry solution,” Cai continued. “Typically with paradigm shifts, it’s a behavioral change that is needed, where you have to reprogram a whole society to open the door for a demographic that hasn’t had a door open for them for a long time.”

Raising up The Middle Class

A silver lining for LatAm, however, is that according to nfx.com, a website built for business founders by founders, fragmentation is one trait that can actually drive significant value within an economy. On the one hand with fragmentation, there is a huge opportunity for startups that can solve the efficiency problems of a business economy that is still getting its footing—problems that already have solutions elsewhere.

On the other hand, however, when you’re trying to grow a company, it’s critical to have high levels of certainty in your market and operating environment. This creates a bit of a conundrum for newer startups and smaller businesses.

“For people running smaller businesses, they don’t yet understand all the different types and complexities of technologies that are needed to run a company at scale,” says Cai. “This is especially true for more traditional businesses in service that tend to universally lack access to markets and don’t yet have digital marketing know-how.”

This is manifesting business competition in LatAm that looks a little different, where relevant businesses are harder to build in 2022, but at the same time, there is also less competition—making both the risks and rewards unique to the LatAm region. This ends up causing the continued separation in business opportunities based on class, because those that can invest in their business or get the investment they need will prosper, but those who cannot fall by the wayside.

According to Cai, the needed solution comes from bolstering the middle class, because it will help to bridge the gaps between all levels of the economy and make for a more level socioeconomic playing field within the region.

“If you think about the collective asset book value of all the microfinance added together, versus the capital needs of that entire ecosystem of the informal middle class to lower-middle-class economy, the financing is a tiny, tiny fraction of what’s needed,” said Cai.

Elevating VC in LatAm

Private equity hasn’t generally done well in the LatAm region for an onslaught of different reasons to date, but mainly because of who the asset allocators are. In part, this is because Latin America still lacks a lot of the entrepreneurial infrastructure that startups need, such as more seed investors. It also has to do with the fact that international private equity firms haven’t been willing to allocate funds to local private equity firms—making the area starved of capital.

Despite this broken past, the tide seems to be turning in LatAm’s favor, with VC investments coming in at more than $15.7 billion for the region in 2021, more than in the previous ten years combined, and private capital as a whole reaching a new record of $29.4 billion in the region.

Cai’s company, Polymath, is a venture studio that is geared at being a liaison to LatAm as it navigates this huge metamorphosis. Helping to build large and transformative companies for LatAm’s emerging middle-class, they believe that a sizable and empowered middle class is the foundation of a more equal, stable, and prosperous society.

This in turn makes for a more fertile investment marketplace for venture capitalists. As LatAm puts itself on the VC map, it is important to keep these metrics in mind so that its investment boom can be not only prosperous but one that is equitable as well.