What caused so many world leaders to stick their heads in the sand and act as though the novel coronavirus was not going to spread?

Cast your mind back to a couple of weeks ago. Did you really think that by now you’d be holed up in your flat deciding whether to spend the next half hour worrying about a killer virus, a crime wave, or an economic depression?

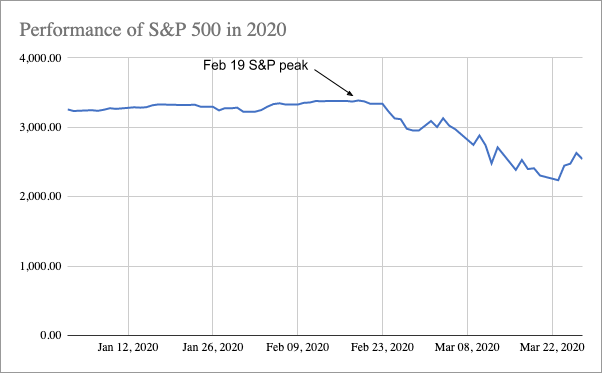

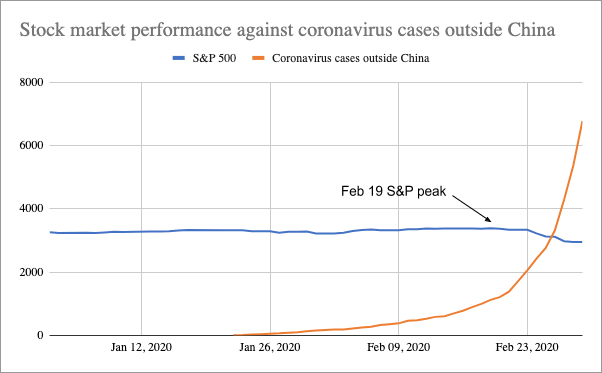

If not, you’re far from alone. Just last month, the US stock market reached an all-time high on February 19, a full three weeks after Wuhan had been locked down, and at a time when COVID-19 was displaying indisputable exponential growth outside of China. If it seems totally irrational that the entire world could have underestimated the importance of something that now feels like it was depressingly foreseeable, that’s because we humans, alas, are far from rational creatures, and all too susceptible to an array of cognitive biases with one thing in common: We don’t make decisions based on how we think, but how we feel.

Do you remember September 11, 2001? What about when Donald Trump defied the odds to be elected US President, or Britain voted to leave the European Union? Perhaps a particularly stunning event – good or bad – in your own life? You were probably thinking something along the lines of I can’t believe this is actually happening, even though looking back, the writing was on the wall.

The likely explanation is that you were blindsided by normalcy bias, also known as the ostrich effect. In a nutshell, it is a tendency to believe that things will continue to function more or less as they always have done in the past. In evolutionary terms, this is a sensible shortcut, since it is more efficient to assume that sabre-toothed tigers are always unfriendly, shiny fruit always tastes good and it’s better to be inside your cave during a thunderstorm, than to re-evaluate matters from first principles every time. But this evolutionary coping mechanism misfunctions horribly when it comes to impending disasters. When the statistics told us what was coming, we searched our memories for devastating pandemics, came up blank, and shrugged.

Of course, it depends on what you consider to be normal. Tellingly, Bogotá started its quarantine last Friday, when there were just 54 confirmed cases in the city. New York State, on the other hand, waited until its number of infected had topped 10,000 before declaring a full shutdown. This pattern was replicated worldwide: At time of publication, the table of countries with the most COVID-19 cases shows five members of the G7 in the top nine places. Could it be that in nations like Colombia, where civil unrest and security issues never feel far away, chaos is simply easier to imagine – and even remember – so governments spent less time in denial and resorted more swiftly to unpalatable but inevitable action than those of wealthier nations? Normalcy bias would suggest so.

OK, but what with quarantine being the new normal, can we be trusted to think rationally from now on? Not so fast…

Thanks to the drastic measures taken recently, the spread of the virus throughout Colombia will hopefully slow down next week. The emergency package announced on Wednesday means that the poor have a lifeline, for now. And the country’s newly created Emergency Mitigation Fund ensures that for the moment at least, the money is there.

However, you don’t need to be a behavioural economist to know that we have an unfortunate tendency to value today much more than tomorrow. Anybody who has ever overspent on payday, drunk too much on a weeknight or procrastinated on an assignment will recognise the gnawing regret that follows.

Read all our coverage on the coronavirus in Colombia

Faced with the offer of $15 today or $30 in three months’ time, experimental subjects traditionally display indifference to the two options, to the chagrin of traditional economists and vindication of their behavioural counterparts. Once again, human nature rears its irrational head.

Due to this bias, known as hyperbolic discounting, we consistently overvalue the short term at the expense of the long. To be clear, free cash today really is slightly better than the same amount in three months’ time – though not as good as double – and we need to survive today to even see tomorrow, but studies show that we will neglect the future to an excessive degree.

With cognitive biases in mind, what we can expect to see is a gradual build-up of problems for the second half of the year and beyond, which are too distant to consider now, but will loom larger and uglier as the months pass by.

Once the immediate emergency has abated, the oil price crash from early March and its huge impact on Colombia’s economy will likely come back into focus, the swollen debt-to-GDP ratios of sovereign states around the globe will be there in black and white to horrify fiscal conservatives, and we will discover that priorities from earlier in the year not only still exist, but are way behind schedule.

Speaking of which, on April 5, 1987, El Tiempo’s front page boasted that “Bogotá [would] have a metro in three years!”. Similarly optimistic predictions abound, with almost any large-scale government project virtually guaranteed to take longer and cost more than anticipated. We are all familiar with this bias on a personal level too: Just sending a simple email or getting ready in the morning can leave us looking at the clock in disbelief and wondering where all the time went.

So if you’re indignant at the six days of quarantine that Bogotá’s needy had to endure before the government finally announced details of a package to provide food for the capital’s poorest and most vulnerable families, you may want to direct your wrath at the planning fallacy, our tendency to underestimate the time and costs of future actions, especially if they pertain to complex situations.

A type of optimism bias, the planning fallacy stems from our propensity to imagine things running smoothly and inability to deal with compound probability. “The more steps you have in whatever project or task you’re working on, the greater the chance that in one of those steps you’re going to hit a snag and it’s going to turn out to be atypical”, writes Julia Galef, co-founder of the Center of Applied Rationality.

Somewhat worryingly for humanity, we now face a plethora of uniquely complex challenges with innumerable steps and inevitable setbacks, and both history and behavioural science tell us that finding a solution will be an even harder and longer process than we think.

Phil Dyer first came to Colombia on holiday in 1995. He spent the next few years realising how much worse England was before finally giving up and flying back to Bogotá. When not writing articles, he teaches English to corporate clients, translates academic papers, and gets annoyed whenever he hears ocho, quince, or especially veinte días.